價格:免費

更新日期:2020-07-27

檔案大小:45.5 MB

目前版本:1.5

版本需求:系統需求:iOS 9.0 或以後版本。相容裝置:iPhone、iPad、iPod touch。

支援語言:英語

UOBAM Invest is your personal robo-adviser to help you build your future wealth.

Start your robo-investing journey with a portfolio that reflects your life goals, risk profile and personal investment preferences.

What’s in it for you?

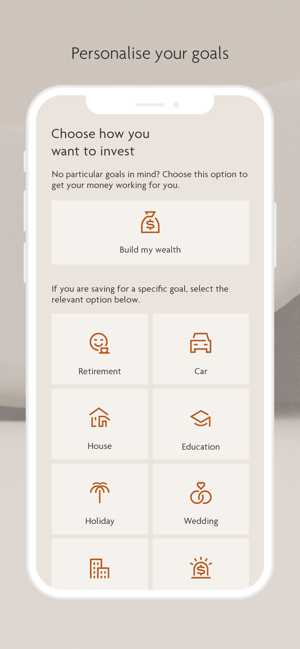

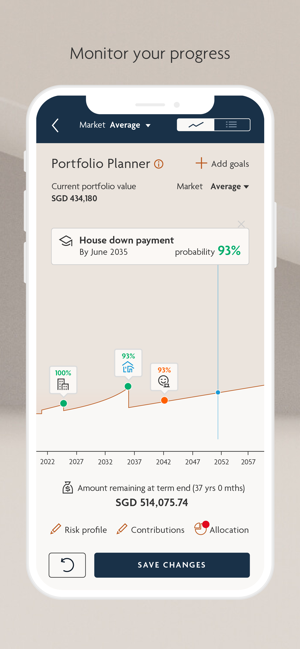

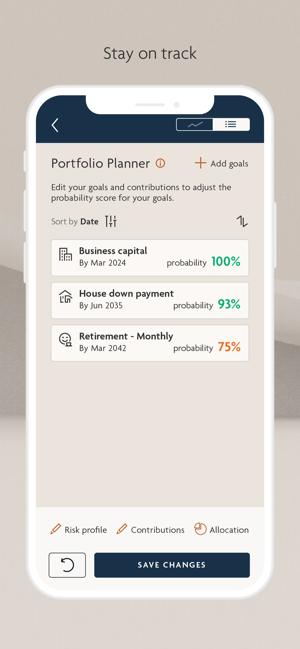

Receive a customised investment portfolio that’s built around your personal goals, such as saving up for your children’s education, purchasing a new house or a car, or setting aside funds for your retirement.

You will have decades of investment experience and institutional fund management expertise at your fingertips. We care for your money with our institutional-grade fund management process and solutions.

Enjoy our no minimum investment amount, no account opening or closing fees, unlimited and free withdrawals, and our fees include rebalancing and trading platforms charges.

We have weathered market cycles with our investors for more than 30 years and we will be there for you as you invest for the future.

Visit UOBAM.com.sg/UOBAMINVEST to find out more.

UOBAM Invest is powered by UOB Asset Management Ltd

UOB Asset Management Ltd (UOBAM) is a leading Asian asset manager with award-winning investment expertise in fixed income, equities, and multi-asset solutions integrating traditional and alternative capabilities. Established as a wholly-owned subsidiary of United Overseas Bank in 1986, we have grown into a regional powerhouse of the asset management industry in Asia. Find out more about us at UOBAM.com.sg.

If you require any assistance, please contact us at

Email: uobaminvest@uobgroup.com

Tel: (65) 6532 7988

Hotline: 1800 22 22 228 (8am to 8pm daily, Singapore time) | (65) 6222 2228 (calling from Overseas)

--- Disclaimer ---

All screens shown are for illustration only. Any reference to any asset class is used for illustration or information purposes only and you should not rely on it for any purpose. Any prediction, projection or forecast shown is not indicative of future or likely performance of any portfolio.